Any company, small or large, relies on accurate financial statements to make smart choices. The most important tool in ensuring financial accuracy is the Bank Reconciliation Statement (BRS). The statement may seem formalistic at first, but when done regularly and accurately, it protects a company from costly errors, dishonesty, and financial blind spots.

What is Bank Reconciliation?

Fundamentally, bank reconciliation is the adjustment of a company’s internal accounting records (the cash book) to the bank’s records (the bank statement) in order to make both equal the same cash balance.

You may wonder—shouldn’t they always be the same? Ideally, yes. But in the real world, timing differences, delays at banks, and human or system mistakes tend to cause differences. Reconciliation fills this gap by finding and accounting for every difference until both accounts agree.

Imagine this: Your books say you have ₹2,50,000 in the bank, but the bank statement shows ₹2,30,000. Where did the ₹20,000 go? It could be a cheque that hasn’t cleared, a bank fee you forgot to record, or even a fraudulent transaction. A BRS helps you find out.

Why Do Differences Arise Between Cash Book and Bank Statement?

1. Timing Differences

- Cheques Issued but Not Presented: You’ve issued a cheque to a vendor, but they haven’t yet deposited it. Your cash book reflects the deduction, but the bank doesn’t.

- Cheques Received but Not Cleared: A customer pays you by cheque. You’ve made the deposit entry, but the bank hasn’t cleared it.

2. Direct Bank Entries

- Bank Charges or Interest: Usually, banks debit charges or credit interest. In case it is not entered in the cash book, this will result in a difference.

- Auto-Debits & Standing Instructions: EMIs on loans, SIPs, or other regular payments may be auto-debited, catching you off guard if not tracked.

3. Recording Errors

- In the Cash Book: You can enter the transaction twice or with the wrong value.

- In the Bank Statement: Banks can also err, although this is uncommon.

Key Components of a Bank Reconciliation Statement

A BRS is not a checklist—it has a logical format. It generally includes the following:

- Opening Balance: The balance of either the bank statement or cash book.

- Additions: Merchandise that increases the bank balance (i.e., uncleared deposits).

- Deductions: Items that reduce the bank balance (e.g., unpresented cheques, bank charges).

- Adjusted Closing Balance: Adjusted balance after making all adjustments.

Bank Reconciliation Statement Format

There are two standard formats, depending on where you begin: from the balance of the cash book or from the balance of the bank statement. Both are attempts to reach the adjusted (true) balance.

Let us examine the structure:

Format 1: Starting with Cash Book Balance

| Particulars | Add/Less | Amount (₹) |

| Balance as per Cash Book | X | |

| Add: Cheques issued but not presented | Add | Y |

| Less: Cheques deposited but not cleared | Less | Z |

| Less: Bank charges not recorded | Less | A |

| Adjusted Balance as per Bank Statement | Final |

Format 2: Starting with Bank Statement Balance

| Particulars | Add/Less | Amount (₹) |

| Balance as per Bank Statement | X | |

| Add: Deposits not yet credited by the bank | Add | Y |

| Less: Cheques issued but not presented | Less | Z |

| Less: Auto-debits not in the books | Less | A |

| Adjusted Balance as per Cash Book | Final |

Step-by-Step Guide to Preparing a BRS

If you’re preparing a BRS manually or even using software, the process usually follows these steps:

Step 1: Collect Statements

Get the cash book and bank statement for the same period. These are your main documents.

Step 2: Look for Similar Entries

Match every bank transaction with the cash book. Mark off all similar entries.

Step 3: Mark Differences

Make a note of mismatches, like missing entries, timing discrepancies, or direct bank debits.

Step 4: Modify the Cash Book (if needed)

If you have postings such as bank fees or auto-debits that do not appear in your books, enter them before reconciliation.

Step 5: Make the BRS ready

Use the format described above to reconcile and balance systematically.

Step 6: Verify

The final step is validation. Your adjusted cash book balance should match the adjusted bank statement balance.

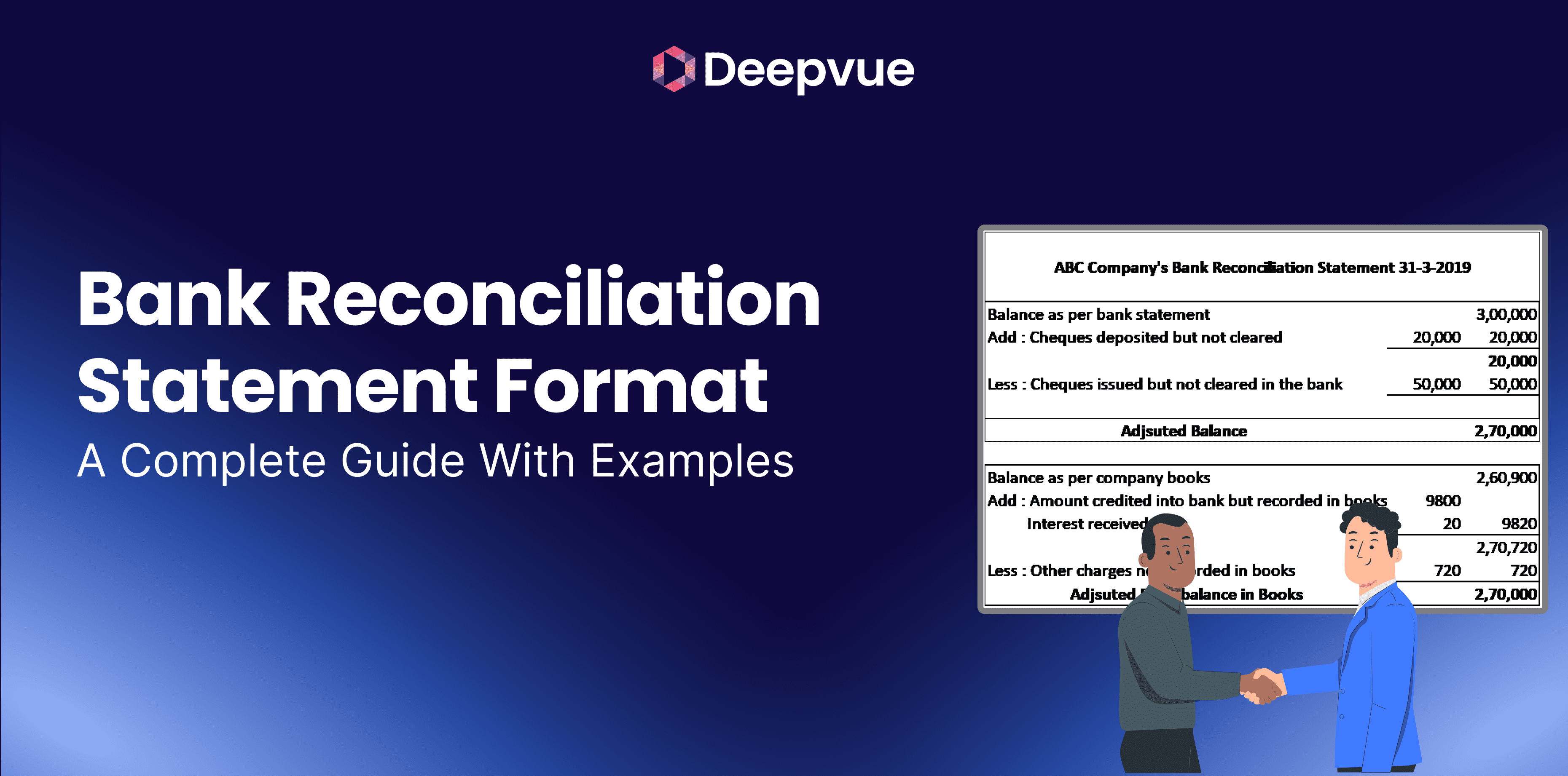

Bank Reconciliation Statement Example

Let’s make this simple using an example.

Scenario:

- Cash book balance: ₹1,00,000

- Cheque issued to supplier (not presented): ₹10,000

- Cheque deposited from client (not cleared): ₹15,000

- Bank charges not recorded: ₹500

BRS (Beginning with Cash Book):

| Particulars | Add/Less | Amount (₹) |

| Balance as per Cash Book | 1,00,000 | |

| Add: Cheques issued but not presented | Add | 10,000 |

| Less: Cheques deposited but not cleared | Less | 15,000 |

| Less: Bank charges not recorded | Less | 500 |

| Adjusted Balance as per Bank Statement | 94,500 |

Common Errors to Shun

- Overlooking minor charges: Service tax or bank charges can appear small, but they can upset your balances.

- Failure to update the cash book in real-time: Late additions result in inaccurate reconciliations.

- Neglecting old unpresented cheques: They can have to be re-issued or cancelled.

- Blending personal and business accounts: Reconcile business accounts separately always.

Benefits of Regular Bank Reconciliation

- Fraud Detection: Quickly spot unauthorized or fraudulent withdrawals.

- Cash Flow Control: Know exactly how much liquidity you truly have.

- Compliance & Audit Readiness: Clean records simplify statutory audits.

- Error Resolution: Rectify mistakes before they become major issues.

How Accounting Software Simplifies Reconciliation?

Many businesses now use tools like Tally, QuickBooks, or Zoho Books, which can sync with bank accounts and auto-reconcile transactions.

Benefits:

- Automatic matching of entries

- Real-time mismatch alerts

- Visual dashboards for exceptions

- Reduced manual data entry, fewer errors

When Should You Bring in a Professional?

If you’re seeing persistent variances, dealing with duplicate accounts, or preparing for a statutory audit, a pro accountant can enlighten.

Not only do they identify errors sooner, but they can also help institute a stronger reconciliation procedure, especially for growing businesses.

Conclusion

A Bank Reconciliation Statement is not just a financial to-do list—it’s your protection against mistakes, fraud, and bad decisions. No matter how you do it, with pen and paper, Excel, or accounting software, it’s about doing it regularly and accurately.

By knowing the format, having clean books, and reconciling on a regular basis, companies can remain financially fit, compliant, and audit-ready.

To make reconciliation even more seamless, our Bank Statement Analysis API automates the extraction, categorization, and interpretation of bank transactions in real time. It highlights discrepancies, identifies earnings trends, signals missing debits or credits, and even assists with matching transactions to in-house records—dramatically minimizing manual labor and errors.

FAQs

What is a Bank Reconciliation Statement (BRS)?

A BRS matches your company’s internal cash records and the bank statement to identify and reconcile differences.

Why do I need a BRS?

It confirms errors are caught, fraud is avoided, and your cash position is reflected correctly.

How frequently should I prepare a BRS?

Monthly is typical, but weekly for companies with high transaction volume.

What are the common reasons for mismatches?

Cheques in transit, direct bank entries, unrecorded charges, or manual entry errors are common causes.

Can I use software to automate BRS?

Yes, tools like Zoho Books, Tally, and QuickBooks offer bank reconciliation features that automate much of the process.