For years, bank statements were printed on paper. They landed on your doorstep each month, stamped in envelopes, with all your transactions and information from the account. But now, with everything from shopping to tax filing going online, bank statements have changed as well. Enter the e-statement: a faster, safer, and smarter way to track your money. This blog explores what an e-statement really is, how it functions, and how you can get one.

What is an E-statement?

An e-statement, or electronic statement, is a digital version of your traditional paper bank statement. It has the same basic information, including account information, transactions, and balances, but is sent electronically rather than through the mail. You can view it via email, your bank’s website, or a mobile banking app.

In contrast to printed statements, e-statements are typically found in downloadable files like PDF or Excel, where they can simply be saved and shared as the need arises. If it is your savings account, credit card, or loan account, most banks have e-statements as the default for their customers.

How Does an E-statement Work?

The mechanism behind e-statements is quite simple. Banks or financial institutions generate digital statements periodically, usually monthly. These are stored securely in their database and provided to customers through online portals or via email.

The user is alerted by email or SMS when a new statement is available. Banks send it as an attachment in some cases, and a secure download link in others. Such files tend to be password-protected to ensure secrecy. The password could be your date of birth, account number, or your own chosen combination.

For instance, an e-statement for a credit card will detail all your transactions, payments, charges, and due dates for one month, similar to a paper statement, but at your fingertips.

Benefits of E-statements

- Instant Access: Say goodbye to the wait for the post. Get notified and download instantly.

- Environmentally Conscious: Conserves paper, printing, and postage.

- Cost-Effective: Saves the bank’s operating expenses and you on courier fees.

- Organized Storage: Simply store on your device or cloud for future use.

- Enhanced Security: Provided through encrypted emails or password-protected portals.

- Simplifies Tax & Loan Processes: Easy to share with your CA, banker, or advisor.

It is a win-win situation for both customers and institutions.

How to Get an E-statement?

a. Through Net Banking

- Log in to your bank’s net banking portal.

- Navigate to the ‘Account Statement’ or ‘Documents’ section.

- Choose the account and the period.

- Download it as a PDF or Excel file.

b. Via Mobile Banking App

- Open the bank’s mobile app.

- Tap on ‘Statements’ or ‘Documents’.

- Select the month or range.

- Download or email it to yourself.

c. Through Email (Auto Delivery)

- Register your email ID with your bank.

- Opt-in for e-statements.

- Receive statements directly in your inbox monthly.

d. Customer Support or WhatsApp

- Some banks allow you to send a request via WhatsApp or a phone call. The statement will be mailed to your registered email ID.

Security of E-statements

One might wonder: Are e-statements really safe?

Yes, they are very secure if accessed responsibly. The majority are:

- Password-Protected: Only you have the access credentials.

- Encrypted: Both at storage and transmission.

- Access Restricted: Gains access only through secure logins or OTPs.

But users need to be careful as well. Refrain from checking e-statements through public Wi-Fi, don’t share credentials, and keep your email account always safe with two-factor authentication.

Common Use Cases of E-statements

- Proof of Income: Required while taking loans or credit cards.

- Visa Applications: Banks usually request bank statements.

- Tax Filing: Helps monitor interest income and investments.

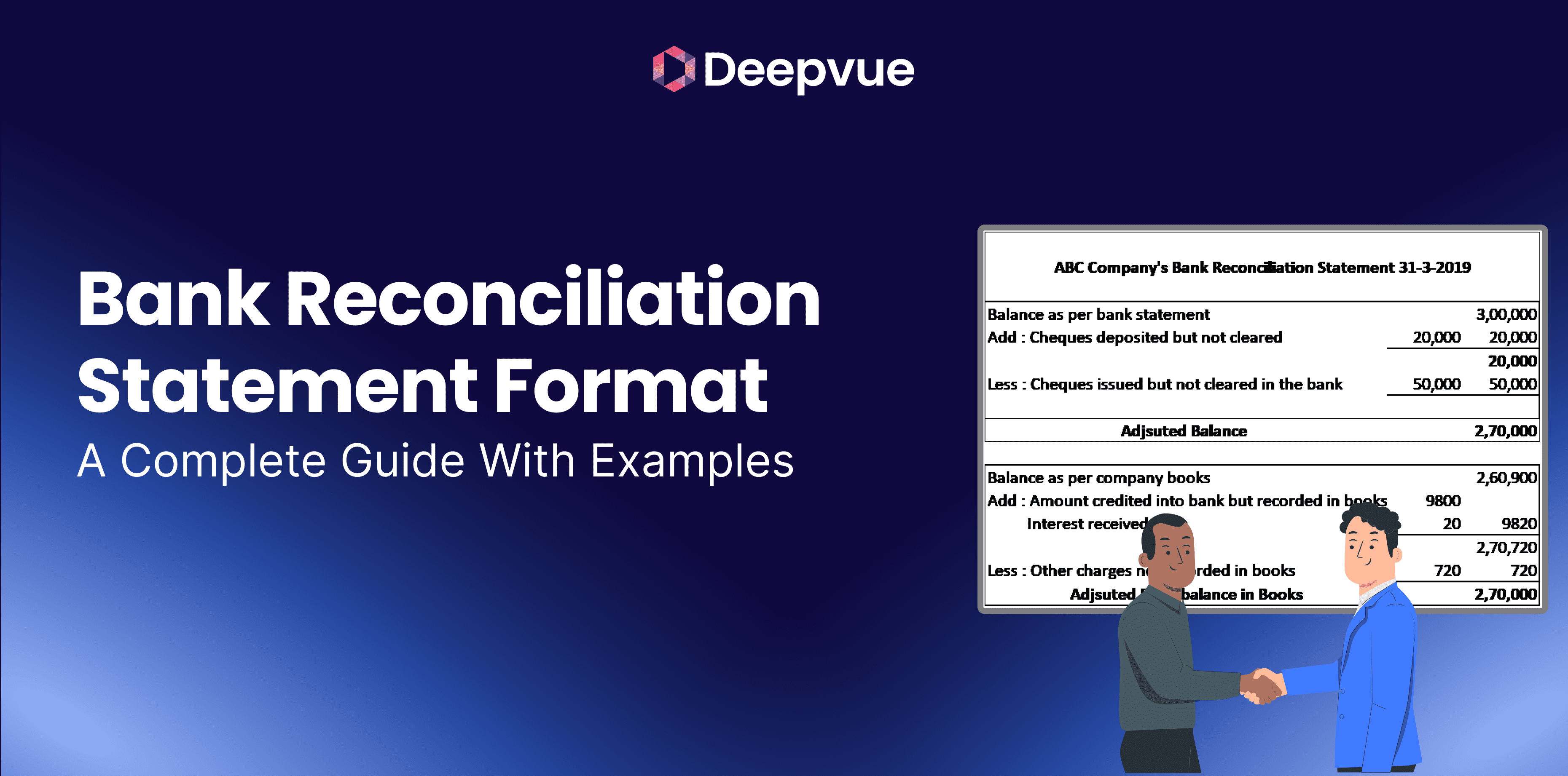

- Audits: Companies use them for account reconciliation.

- Budgeting: Personal finance tools used to analyze spending.

Why E-statements Are Here to Stay?

The digital age demands convenience, speed, and security. E-statements meet all of these expectations. With institutions going paperless and users expecting instant access, electronic statements are not just a trend. They are the new normal.

They simplify how we track money, plan budgets, apply for loans, and prepare taxes. And with improved security and convenience, there is not much incentive to return to paper.

Why Our Bank Statement Analysis API Delivers Value?

Although e-statements present a snapshot of your financial transactions, it takes time to analyze them manually. That is where our Bank Statement Analysis API steps in. It is able to download, parse, and classify data from e-statements within seconds.

Whether you are a lender assessing creditworthiness, a platform monitoring cash flow, or a business automating reconciliation, our API simplifies it all. It identifies transaction patterns, flags inconsistencies, and delivers actionable insights using only the statement data you already receive.

For any organization that deals with financial verification or onboarding, it brings speed, accuracy, and intelligence to a process that was once slow and manual.

FAQ

What is the full form of an e-statement?

E-statement stands for electronic statement. It is a digital version of your traditional bank statement.

How can I open my e-statement PDF?

Most e-statements are password-protected. The password is usually your date of birth or a unique combination shared by your bank.

Can I get e-statements for credit cards, too?

Yes, credit card e-statements are common and show all transactions, payments, and outstanding dues for a billing cycle.

Are e-statements free?

In most cases, yes. Banks provide e-statements free of charge, unlike physical statements, which may carry a fee.

How long are e-statements stored online?

Most banks keep them for 6 months to 5 years. You can download and store them for long-term access.